Transformation of business: shift to the subscription economy

Content

Introduction1.

Market evolution

.1.Transformation

of business: shift to the subscription economy

.2

Subscription based economy model overview: characteristics and functions2.

Subscription Models applied in SaaS businesses

.1

SaaS Subscription model: key features, market drivers and deterrents

.2

SaaS in Russia: trends, problems and opportunities

.3

The impact of SaaS subscription services on the economy and the society3. Real scenarios of SaaS

infrastructures and applications

.1

SaaS Subscription businesses: comparison of foreign and Russian cases

.2

SaaS Subscription model in (ADD)

.3

Success strategies to attract and retain subscribers123456

Introduction

situation on the market is constantly

changing. The nowadays consumers are more attentive and look for newer, more

convenient and easier ways of accessing goods and services. There is a common

idea of the “right now” need, which means that a product cannot be delivered

later. It should come at the right moment to satisfy a spontaneous and

transitory wish. But, at the same time, as it is known that the wish is

transitory, there is a need to be able to stop using this product as fast as it

is not useful anymore (Hutzler, August). They do not necessarily want to buy a

product that can became very quickly old-fashioned or dysfunctional. In the

report prepared by The Economist Intelligence Unit in 2014, it is said that “80

percent of customers are demanding new consumption models including

subscribing, sharing, and leasing - anything except actually buying

a product outright” (Tzuo, The subscription economy: a business transformation,

2015), in other words, that are the models that mainly respect an idea of

temporary acquisition.means that businesses need to handle customer loyalty,

pricing, and selling strategies in a very different way to keep their

successful relationship with their consumers alive. Since consumers are

trending towards a hassle-free shopping experience, more and more companies,

looking for new growth opportunities, are changing their business strategies

from a pay-per-product model to a subscription based model. Indeed, this

subscription model is not new - for instance magazines and newspapers have been

selling subscriptions for few centuries (Warrillow J., 2014). But, more

recently, new sorts of industries have adopted the idea of intensifying the

subscription based model selling strategy. The year 2007 was called by experts

a focal milestone in the global shift from the traditional economy to the

subscription economy (Zuora). Since then, over all the industries, this change

happens more evidently in the software industry with the transition from a

per-pay-use license model to the SaaS subscription model (Longanecker, 2015).paper

is focused on the software-as-a-service (SaaS) as its success is becoming

largely noticeable around the globe. Over the past few years, commercial cloud

computing (SaaS is a part of this phenomenon) has been rapidly increasing in

gaining market share (Darrow, 2011), making new possibilities available for

both software vendors and consumers. These changes happen with a sustained

attention of the traditional perpetual software markets: without deep knowledge

about cloud computing, new business and revenue models, strategies of

attracting and retaining consumers, they risk to lose their weight in this new

business reality. In the research Global and Russian SaaS-Solutions Markets in

B2B Segment presented by J’son & Partners Consulting in July, 2015 it is

said that “In accordance with IDC forecasts, 27.8% of global corporate apps

will be based on SaaS model by 2018, it will generate $50.8 bln revenue in

comparison with $22.6 bln and market share of 16.6% in 2013” (Consulting, J’son

& Partners, 2015).subscription model is a global trend which could not

stayed without attention in the Russian business landscape. Experts from

Paralleles estimate that the share of SaaS in the cloud solutions sales in

Russia reached about 70% and in the segment of small and medium businesses

almost 90% over the last few years. Another analysis provided by iKS-Consulting

estimates the pace of growth of SaaS market to be around 25% in 2015-2018. The

SaaS market is growing despite the fact that the Russian IT industry is

generally stagnating (CNews Analytic, 2015).

Problem statement

The leading players of the Russian

software market express different opinions about perspectives of SaaS

subscription model in Russia. While the smallest part of the software companies

managed already to find and take their unique market niche and are successfully

expanding their businesses now, the biggest part of suppliers demonstrates much

modest growth of their SaaS services. But in this new realities, it is becoming

important to understand how SaaS subscription model works and more challenging,

how it is changing relationships between companies and consumers to use profits

of basing a business on SaaS model.

Field of study

Subscription economy in Russia

Object of the research

SaaS subscription model

Objective

Derive particular strategies of attracting and retaining

subscribers of SaaS platforms with the subscription business model.

Tasksachieve this objective, the following tasks are

formulated:

. Analyze theoretical and methodological aspects of the

subscription economy;

2. Define features of the SaaS subscription business

model;

. Prepare and interpret a database of the cases of the

Russian and foreign SaaS solutions for business with subscription business

model;

. Check hypothesis of the study that the subscription

model, applied in a software company suit better clients’ needs but it can

distract clients if implemented carelessly.

Methodology

Structure-functional analyzes

Methods

General methods: Literature review, researching academic

articles related to subscription economy and SaaS industry with focus on the

subscription model and Russian SaaS market.method: Case study

Research questionshifting from the traditional

licensed model to the subscription model in the software business help attract

new customers and turn old clients into subscribers?

The hypothesis of the study: Hence customers have very

specific needs but do not want to pay for a customized solution for their

problems, the subscription model, applied in a software company, will suit

better clients’ needs.

Delimitations of the study

This paper studies a very specific kind of companies that

implement the subscription model which are the software-as-a-service (SaaS)

companies. The SaaS business model, in general, is quite well examined field in

the literature. Nevertheless, it is still possible to find less explored issue

such as the SaaS as a part of the subscription economy. Moreover, we will focus

on studying SaaS subscription model applied by the Russian providers of the

software solutions mainly for business purposes. This study is an attempt to

bring new ideas into chosen issue, mainly concerned with the implication of

this model into the Russian business landscape.

Professional significance

The research organizes and explains the basic theoretical

concepts, practical tools and strategies of attracting and retaining

subscribers in the subscription models applied in SaaS businesses.

Definitions of key termseconomy

This term describes the business

process of offering subscriptions to consumers. It was not popular in consumer

marketing until recently, yet there is an opinion that subscription concept is

nothing new - for example, in publishing it goes back to 17th

century. The term describes a new business landscape in which the traditional

pay-per-product (or service) companies are moving toward the subscription-based

business model. For some companies, their entire business relies on the

subscription business model. Here can be named such companies as Netflix,

Spotify, Zipcar, and all SaaS companies (Tzuo, The subscription economy: a

business transformation, 2015).

SaaS Subscription model

A business model where a customer gets an access to the

product or service after paying a subscription price. The model was pioneered

in publishing few centuries ago - at least at 17th century, but is

now used by many businesses in different industries (Longanecker, 2015). To

clarify grammatical side of using the term “the SaaS subscription model”, we

should notice that in our research, the terms “the SaaS subscription model”

(sg.) and “the SaaS subscription models” (pl.) are equal and substitutable.

But, being more precise, the term “the SaaS subscription model” (sg.) is used

as a name of a general phenomenon in economics while “the SaaS subscription

models” (pl.) phrase encompasses variable types of the SaaS subscriptions which

is based on the classification which suggests two core SaaS subscription

models:

1. Monthly Subscription Model: In the Monthly

subscription model a client is charged and pays each month via credit card of

automatic e-payments. An electronic license agreement does not include any fee or

penalty for cancelation of the subscription at any time.

2. Term Subscription Model: In the Term subscription

model a client pays for a certain period of time (mainly 3, 6 or 12 months).

The subscription agreement frequently includes fees for cancellation during the

term.

Software-as-a-service (SaaS)

A model of licensing and delivering software in which vendors

or service providers, instead of selling it to companies, make it available to

customers over the internet on rental base using cloud-computing technology.

Freemium

Freemium (from 'Free' and 'Premium') is considered to be a

pricing and marketing strategy which can be applied in either the monthly or

term subscription models when a core product is given for free to a large group

of users and premium products are sold to a smaller fraction of this user base (Froberg,

n.d.).current research paper Subscription Model applied in SaaS Subscription

businesses: characteristics, functions, strategies to attract and retain

subscribers consists of an introduction, three chapters, conclusion,

references and applications.

Literature

review

The paper is based on a deep review of the business and IT

books and articles taken from professional sites. We also used information from

professional forums and online versions of business newspapers which covered

the chosen issue.how firms do business is the first step to understand how a

marketing strategy can affect a company’s future. Business models have been

widely explored in literature and it is increasingly suggested that business

model innovation is a key to business success (Lev-Ram, 2014). Indeed, a

business model is a concept that embodies architecture of a business with the

aim of creating value for customers (Teece, 2010). In his work Teece says that

business model articulates how the company will convert resources and

capabilities into economic value. The business model follows the context where

the company is inserted. To accomplish a revision of the business models, we

put attention on the research A literature and practice review to develop

sustainable business model archetypes (Bocken, N.M.P., Short, S.W., Rana,

P.,&Evans, S., 2014) where the authors give in-depth observation of the

theoretical base of this subject. According to this paper, “a business model is

a conceptual tool to help understand how a firm does business and can be used

for analysis, comparison and performance assessment, management, communication,

and innovation”.models have been defined and categorized in many different

ways. It is possible to think in two main business models, the traditional

model and the internet based one (Rappa, 2008). In this paper we focus our

attention on the internet subscription based model applied in SaaS.the SaaS

(Software-as-a-Service) business model is one of the most recent trends in the

contest of business models analyses. A research Saas (software as a

service)-infrastructures and applications in real scenarios (de Miranda, 2010)

gives a profound review of the origins of the SaaS business model. Miranda says

that the SaaS business model became a successor of the ASP (Application Service

Provider) business model, which in its turn appeared to deliver software to a

broader market share. As a new business model, the SaaS emerged to fix ASP’s

“disadvantages and covet its opportunities”.the author emphasized, in contrary

to ASP, SaaS clients “don’t have to buy the software solution and then pay the

provider to host it, but rather just pay for the usage of the service”.

Moreover, the clients get better assess the costs since the payment model is

based on a monthly/annually fee. Another advanced feature described by Miranda

is that SaaS provides makes stronger protection of intellectual property, which

results can be seen in the cases of revenue stream or the proprietors of the

software solutions.of the most significant articles for us focusing on SaaS

phenomenon became an article Software as a Service (SaaS): An Enterprise

Perspective written by the Microsoft Corporation’s authors (Carraro G., Chong

F., 2006) in the period when it was not yet trendy to study it. They addressed

SaaS from the perspective of the enterprise consumer. The authors write that

“SaaS application access is frequently sold using a subscription model, with

customers paying an ongoing fee to use the application. Fee structures vary

from application to application; some providers charge a flat rate for

unlimited access to some or all of the application's features, while others

charge varying rates that are based on usage”. That makes clearly reasonable for

them that the subscription model in comparison to the one-time licensing model

“is expected to take advantage of the benefits of centralization through a

single-instance, multi-tenant architecture, and to provide a feature-rich

experience competitive with comparable On-Premise applications”.the PwC report

(PricewaterhouseCooper, 2007) where the key findings about the current software

industry environment were provided it became well-defined that consumer behavior

had changed a lot recently and that vendors now are reevaluating their software

pricing and delivery models to accommodate this change. In this research

prepared nine years ago there was also already noted a process of shifting from

up-front paying to periodic payments. Nevertheless, it took a long time for

this trend to become widely discussed and studied which resulted in high

relevance of this issue in last two years among software vendors.most

interesting part of the PwC report is the forecast given up to 2016. They

predicted the spread of the SOA (service-oriented architecture) among both

vendors and consumers: as for enterprise consumers, “it gives them full control

over the value they leverage from their software”, meanwhile the vendors get an

opportunity “to integrate their applications in real life for customers and

other vendors”. All this forms “a stable service-delivery environment where

customers have traded vendor subscriptions and infrastructure lock-in for true

agility and customization”.to the book The Automatic Customer: Creating a

Subscription Business in Any Industry (Warrillow J., 2015), the lifeblood of

the business is repeat customers, or, how he is calling them in the book,

automatic customers. According to John Warrillow, companies that know how to

find and keep subscribers, get the huge opportunities offered by the emerging

subscription economy. He claims and proves in his work that “automatic

customers are the key to increasing cash flow, igniting growth, and boosting

the value of your company”. The author shows that subscriptions are not limited

to technology or media businesses. Companies in almost all the industries, from

start-ups to the global corporations can implement subscriptions models into

their business to gain more. Warrillow provides a breakdown of nine different

types of subscription models for winning automatic customers and illustrates

them all with instructive examples. His blueprint included the following:

. Membership website model;

2. All you can eat library model;

. Private club model;

. Front of the line model;

. The consumables model;

. Surprise box model;

. Simplifier model;

. Network model;

. Peace of mind model.

The ideas given in the book are universe and can be applied

in any kind of industry. We used this list to specify subscription models which

could be useful and profitable for SaaS businesses.big step in exploring the

core difference of the subscription economy from the traditional one was made

by the Anne Janzer in her book Subscription Marketing (Janzer, 2015). In this

book she shared all her knowledge accelerated with more than 20 years of

experience working with the high tech businesses. The main point described and

explained by the author in this book is of a high significance for subscription

marketing. She suggests a new label - value nurturing - to identify the process

“of helping the customer realize value from your solution”. She shows that

value nurturing is the fourth important level of relationships between a

company and a customer. The traditional customer journey looks the following

way: firstly, finding prospects (lead generation), secondly, convincing them of

the potential value of the company’s solution (lead nurturing) and then making

the prospect a customer (conversion). Janzer adds that “the marketing

responsibility extends beyond conversion to customer value nurturing”. This

renewed attention on sustaining long-term relations with customers by bringing

value nurturing to their experience instead of focusing on lead generation and

conversion is the prime responsibility of the subscription-based companies who

want to help customers make a smart economic decision.

Chapter

1. Market evolution

1.1 Transformation of business:

shift to the subscription economy

say that 2007 became a year when a new trend started

spreading all over the world: that was so called “once-in-a-century

transformation in the way business is transacted”. From that time on different

companies have started offering an option of subscribing to services instead of

just buying products. That first happened with the big companies like Amazing

and Netflix, but soon other industries added such an option to their services.

In PwC report (PricewaterhouseCooper, 2007) where the key findings about the

current software industry environment are provided it becomes well-defined that

consumer behavior has changed a lot recently and that vendors now are

reevaluating their software pricing and delivery models to accommodate this

change. In this research prepared nine years ago there was already noted such a

trend as shifting from up-front paying to periodic payments. This trend now is

considered to be the hallmark of the 21st century (Tzuo, The

subscription economy: a business transformation, 2015).

It took a long time for businesses to

make this shift from the product-centric pay-per-product transaction model to a

model with the long-term relationships with recurring revenue happen. Experts

say that this process started as a consequence of the wide spread of web 2.0

and the development of online platforms (Kaplan Andreas M. and Michael

Haenlein, 2010)., in the Internet age a phenomenon of “people-to-people

exchanges through technologies” appeared enabling a new kind of economy. That

was a born of the sharing economy. It was a new and alternative socio-economic

system where buying things was not already the only way to consume things.the

research The Sharing Economy: Why People Participate in Collaborative

Consumption (Hamari, J., Sjöklint,

M.&Ukkonen, A, 2015) it is said that the sharing economy should be considered

through the lens of information technologies since this phenomenon “emerges

from a number of technological developments that have simplified sharing of

both physical and nonphysical goods and services through the availability of

various information systems on the Internet”.sharing economy offered

entrepreneurs a wide range of business models based on the idea of availability

of online platforms among which can be named such forms as collaborative consumption,

wikinomics, peer-to-peer file sharing, open data, content sharing in social

media, user generated content, subscriptions, crowd funding, crowdsourcing and

etc. (Matofska, 2014). Later, the sharing economy term has become more

specialized and the subscription based models have been allocated as a separate

direction in the business landscape., subscriptions have been used for many

years by some industries - for example, magazines and newspapers, mobile and

internet operators, cable TV, fitness clubs, public service ad etc. But more

recently, many other new kinds of unexpected industries have started

participating in the subscription economy, offering diverse range of goods and

services from cars to online software for a flat monthly or year fee (Lev-Ram,

2014).“subscription economy” is the term coined by Zuora, “a leading commerce,

billing, and finance solution for subscription-based businesses” (Bastian,

2014). In 2007, CEO of Zuora Tien Tzuo and his partners Cheng Zou and K.V. Rao

started to build and spread around fundamentals of a new business model which

could be used by companies of any size. The idea was to make possible for

companies to offer customers different services via subscriptions instead of

making single transactions and selling separate products.noticed that markets

across different industries are looking for new models of shipping products as

an answer to the increased demand of clients to consume goods in a new way. A

significant point of this new business model was focusing on consumers and

value to them, making them a key player in this process instead of focusing on

the product, or transaction, or value to the brands themselves, as it was in

traditional business model. The sudden idea was to monetize long-term

relationships by offering consumers flexible and personalized goods and

services. Flexibility here is about allowing customers the adaptability to

“either pay as they go, or pay per subscription monthly, or via a long-term

contract” (Whitler, 2016). Personalization in its turn is giving individual

package of service depending on the needs of a particular client., they called

this new business model “the subscription economy”. Inventing this phrase

helped Zuora made a buzz in the most popular business magazines such as Forbes,

Wall Street Journal, Tech Crunch, Fortune, BBC, Huffpost Business. Since the

year 2013, there have appeared many publications explaining what the

subscription economy is and why it is important to put attention on it (to name

just few of them: Zuora Lands $50M From Next World, Paul Allen, Marc Benioff

& More To Help Fuel The Rise Of The Subscription Economy by Rip Empson,

Tech Crunch Sep 5, 2013; The rise of The Subscription Economy by Kyle Hutzler,

Huffpost Business, Jan 08, 2014; It's a subscription economy, and you're just

living in it by Michal Lev-Ram, Fortune, June

6, 2014; How The Subscription Economy Is Disrupting The Traditional

Business Model by Kimberly A. Whitler, Forbes, Jan 17, 2016). Subsequently, the

term took a root in business environment being acknowledged by many experts as

a new trend in economy.experts’ opinions which were provided in the articles

and in the forums were mainly positive and supported the core idea of the

subscription economy phenomenon. Robbie Kellman Baxter, author of The

Membership Economy, claims: “Customers are saying, ‘I’m willing to sign up, set

it and forget it in exchange for a value accrued to me on a regular basis”. He

also emphasized that “It’s a massive transformation that is changing the way

organizations engage with their constituents,” (Guth, 2015) which can be

translated as being a revolutionary shift in economy and not just a passing

trend. Another opinion leader John Warrillow, author of The Automatic Customer

agrees with Baxter stating that “It’s a fundamental change in the way we

think”, which he explains as being more attracted by the brands who advertise

experiences, relationships and belonging rather than by usual sellers. He gives

such a comparison: “It’s a little bit more like a marriage, where the consumer

commits and the supplier says, ‘I’m going to look out for you, watch your back,

and treat you right’” (Guth, 2015).

Talking about the perspectives and reach of this trend, the

market leaders said that “The subscription economy is ever-growing. It's hard

to quantify how big the subscription economy actually is, however, it's clear

that this is the direction that most every service provider is headed” and that

“The subscription or membership economy is huge (Judson, 2015). And good news

is its growing, look at services such as Dollar Shave Club, or Dollar Beard

Club, or even digital subscriptions such as Netflix, or Spotify, these are all

subscription services, it’s the new way of doing business” (Taei, 2015).understand

better, why a shift to the subscription economy is happening we should accept

these two facts proposed in 2014 by Dave Frechette, Vice President of Worldwide

Sales Strategy and Execution at Zuora (Bastian, 2014):

. It comes to stay. Companies that once have changed their

business model to the subscription model rarely convert back. There is no way

back from this transformation which goes through all the economy;

2. Big corporations prefer this model for being

predictable. It gives them more focused and certain forecasts of their revenue

and profitability.

As it was said before, the main attention in the subscription

economy is focused on the consumers and their needs. In other words, there

would not happen such a shift in economy if consumers would not show a tendency

to desire more control and influence over their relationships with brands,

vendors and service providers. The overall internet access and tremendously

fast spread of mobile devices and social networks made consumers being more

involved into all kind of communication processes giving them immediate answers

to all their requests and demands. They got accustomed to the idea receiving

everything they want “here and now” and be also able to select characteristics

and conditions of usage according to their personal preferences. Saying

differently, there has appeared a new type of a customer who wants

brands to serve him how, where and when he wants (Sloat, 2015).

Another big change in consumer

behavior which inspired this shift in economy refers to the demand for new

consumption models: in the report prepared by The Economist Intelligence Unit

in 2014, “80 percent of customers are demanding new consumption models

including subscribing, sharing, and leasing - anything except

actually buying a product outright” (Tzuo, The subscription economy: a business

transformation, 2015). As Saar Gillai, Senior VP and GM at HP noticed in this

report, “Consumers are getting accustomed to pay-as-you-go models, and they

like that flexibility. They can instantly get all the capabilities without

paying up-front for the cap-ex, and they have better control over their

spend”., it is possible and obvious to conclude that the consumer behavior has

changed. To sum up, here can be given the following explanations of this change

provided by various experts:

) Customers today, especially

youngsters, have no strong division between their business and personal

interests and so they expect their business relations being more personalized.

They frequently consider brands as their “friends” with whom they can always negotiate

about any deal and compromise their interests;

2) Customers want to have a

permanent access to an extensive library of information, ideas, solutions and

specific products. The new era of information dictates a rule to be always

aware of the latest updates on the market and be able to use them when, where

and how you want it. Access itself becomes more significant than asset (Guth,

2015);

) Customers do not want to buy

a product that can become quickly old-fashioned or dysfunctional. Instead of

that, they prefer to be able to stop using a product as fast as it is not

useful anymore. Such a behavior is based on a common idea of the “right now”

need, which means that a product cannot be delivered later and it should come

at the right moment to be “real-time experience with immediate fulfillment”

(Sloat, 2015) to satisfy a spontaneous and transitory wish;

4) Choosing a solution whether for personal or business use,

customers now expect to get some value in return for their choice. They believe

it will save them money or make their lives easier, or, at least, will bring

them fun (Janzer, 2015).

Reasons given above make brands and

vendors take more care of earning customer loyalty by presenting on-going value

and memorable services which were supposed to show clear understanding of

customers’ demands and readiness to maintain long-term relationships with every

client.sum up, many experts from the business landscape commit an idea:

companies that eager to be leaders in their industries, maintaining long-term relationships

with their clients and getting financial, technology, market, and customer

loyalty benefits from their relations, need to plan their participation in this

transformation already now.

.2 Subscription based economy model overview:

characteristics and functions

we discovered the relevance of the

subscription model and found out why the transformation from traditional

transaction economy to subscription started to happen, it is necessary also to

go deeper into exploring particular features of its elements to understand

better how it works.

Subscription business model is a model where a customer gets

an access to a product or service after paying a subscription price. That means

that rather than selling individual products, companies are turning towards to

delivering services repeatedly. This changes financial relationships completely

and requiring a new management system.basis of the traditional product world is

the distribution-centric revenue management with the one-time transaction

business model where sales are straightforward (shipping a product and sending

an invoice to a customer to pay it). Additionally, traditional product-centric

approach is tightly connected with implementation of such tools as customer

relationship management (CRM) and enterprise resource planning (ERP) systems

“which support sales automation, customer service, inventory management, supply

chains, and accounting” (Tzuo, The subscription economy: a business

transformation, 2015). The problem is that these systems were not designed for

subscription based businesses, and companies who want to turn their customers

into subscribers should adopt new technologies and management approach to

facilitate their transformation.new management approach in the subscription

model is based on the recurring revenue management (RRM) system: invoices are

generated daily, monthly, quarterly or annually (Warrillow J., 2014). Thanks to

this system, companies get an opportunity to manage the entire subscriber

lifecycle and measure recurring revenue and subscription metrics.is focused on

the individual experience which makes customer fulfillment variable: customers

can request anytime changes in the service adding new users, more services,

changing pricing plans, or simply canceling service. Flexibility of price and

packaging is the main feature of subscription employed to satisfy any kind of

users. Flexibility allows customers to receive a standard subscription

agreement but use the product differently depending on their needs. Thereby,

customer demand in the subscription business model is measured not only by

purchase data but by usage data and purchase data together. Moreover, in the

subscription economy, there are no limits in product availability: a customer

can receive a product or service in that extent which is preferable for him.

Thus, “differentiated value and revenue opportunities have to be created by providing

differentiated product packaging (e.g., different combinations of minutes,

text, and data in a cellular plan)” (Shanahan, n.d.). As a result, inventory

management is replaced with the rate plan management to optimize

revenue.scenario goes beyond the systems designed for one-time transaction

models. That is why revenue management system should be replaced with the

recurring revenue management system which can better handle the complexities

and growing needs of the subscription based businesses.

Chapter

2. Subscription Models applied in SaaS businesses

.1

SaaS Subscription model: key features, market drivers and deterrents

this paper we will not cover technical details which

differentiate SaaS concept from other cloud computing services such as IaaS and

PaaS (the basic structure of the clod computing is given the Application 1).

The focus of this paper is to explore common features which attract customers

to understand how SaaS changes users’ life. This clear idea will help us

consequently find advantages of SaaS subscription model and, as a result, frame

particular strategies of attracting customers and turning them into

subscribers. But before that, the first step should be researching SaaS as a

subscription model.as-a-service (SaaS) phenomenon appeared in late 1990’s when

companies started offering traditional enterprise solutions such as customer

relationship management (CRM), sales force automation (SFA), and Web content

management through a SaaS model. But the idea of shared resource environment and

cloud computing was already formulated in 1960’s by a renowned computer

scientist John McCarthy who won the Turing award for his work in Artificial

Intelligence. In 1961, in his speech to MIT students he claimed that

“computation may some day be organized as a public utility.” Yet this model was

first implemented more than fifteen years ago, it has become a part of the

business vernacular just over the past few years when “SaaS companies have

proven they are able to grow their revenue and customer base through a

subscription licensing model” (Singleton, 2011).common definition of Software

as a Service (SaaS) is “a way of distributing software in which vendors or

service providers, instead of selling it to companies, make it available to

customers over the internet, using cloud-computing technology” (Singleton,

2011). It represents a software distribution model which, in contrast to an

On-Premise deployment model, democratizes the access to software. The crucial

characteristic of SaaS is hosting applications on provider’s service instead of

storing data on users’ machines which gives an access to software from any

computer connected to the internet.to allowing remote access to the software

applications and data via the web, SaaS also varies from On-Premise software in

its pricing model. Typically, On-Premise software is available by purchasing a

perpetual license and also requires additional fees (15%- 20% per year) to

maintain and support it. Any update versions also cost high additional fees. In

SaaS subscription model, users do not need to buy license to use the

application, install its whole complex infrastructure and then pay ongoing

operating and maintenance to support it and keep it updated. As an alternative,

SaaS vendors offer to “rent” a software for a period of time and get a complex

support and automatic updates included in their rental price (Patterson, 2010),

in other words, buyers pay an annual or monthly subscription fee which is

comfortably spread over time. For more detailed comparison of the economics of

SaaS versus Licensed Software revenue models it can be interesting to look

through the article SaaS Revenue Models Win in the Long Run (Key, 2013).are two

types of SaaS which are business software and consumer software. The most

popular SaaS examples are solutions for improving workflow with greater

efficiency: these are various project management systems, task organizers,

collaboration tools, document management platforms. They help organize

individuals’ and teams’ shared and personal projects and tasks, give them a

space for collective distant activity. Besides, such platforms are supposed to

help planning time and resources for multiple projects and users. The target

audience of these solutions is very diverse; they attract all kind of people with

big work routine. This can be freelancers, representatives of all size

businesses including startups, public administrations, student project

groups.pull of SaaS platforms consists of more specified solutions for

particular industries and related activities. Here can be named applications

for such spheres as finance and accounting, CRM, business information and

analytics, human resources, marketing, operations, sales, communication and

others.features which make impact on both business and personal customer

performance are based on the general advantages of cloud services. They are the

following positive attributes:

. Simplicity of adoptionsolutions offer powerful fast

integration of all necessary services within one modern platform that leverages

secure, reliable and high performance database and middleware technologies

which reduce technology difficulty of installation full in-house solution. The

main mission of SaaS solutions is to make it easier to accomplish tasks and

help optimize business processes. SaaS products mainly have drag-and-drop

functions, intuitive interface and simple visuals. They do not require as

necessity coding knowledge (it can be an additional option for advanced users)

and IT-background (Patterson, 2010).

. Pricepopularity of SaaS solutions is also boosted by its

implementation cost. Buying a fully functional in-house system is not always

affordable for companies, especially, for small and medium businesses and

private users. SaaS subscription model with differentiated packages makes it

more cost-effective to acquire the application. Besides, “reduced total cost of

ownership is the primary and most attractive benefit driving SaaS adoption.

SaaS vendors have long touted the benefits of multitenancy, a software

architecture that allows many users to share a single application instance

while retaining their own separate information. Multitenancy cuts costs by

allowing vendors to patch and update the software for many users simultaneously

and allowing many users to share the underlying infrastructure” (Kari, 2014).

. Backupplatforms reduce the possibility of losing data in

case of sudden emergencies such as ordinary computer system crash or less

common nature disaster and civil disorder. Computer itself does not mean much

as all data are backed up by the provider whose server plays a role of buffer

in any unpredictable situation. That is an important issue proved by different

researches: “According to research by KPMG, 70 percent of organizations have

suffered at least one project failure in the prior 12 months, and 50 percent of

respondents indicated that their project failed to consistently achieve what

they set out to achieve” (Oracle, 2013).

. Access to latest featurescloud services open the door for

latest functionality and improved security, usability, patches and bug fixes.

Continues updates are sent as soon as they are ready to consumers and it’s all

done in the background, transparent to the users in your organization. These

upgrades add value to consumer experience as they develop application ecosystem

and give users new ways to collaborate and share information.

. Flexible customization, an integral part of being

competitive in business is to be able to deal with changes easily. This

flexibility requires new features and functionality for applications, for

instance, adding new users to an application dashboard, upgrading original

deployment with additional modules or components, or adopting entirely a new

application. In SaaS platforms it is easy to manage such particular changes without

concerns about changing whole infrastructure.

. Multi-tenancymodel allows the cloud services providers

(CSPs) to locate a single application instance to one tenant (to one client,

despite of its size) with retaining own separate information of each user

rather than putting out single instances to every individual user.

“Multitenancy cuts costs by allowing vendors to patch and update the software

for many users simultaneously and allowing many users to share the underlying

infrastructure” (Kari, 2014), which is attractive to companies with limited

financial resources.

. SaaS Help Desk Solutions, most of the SaaS subscriptions

include customer support which means getting immediate help of the professional

team in any problem situation. Customer Support service tracks and responds to

all the customer inquiries from multiple-channels like online community forums,

phone, email online consultancy, webinars, tutorials, and social media. The

advanced features of SaaS Help Desk Solutions are opportunity to find answers

without anybody’s help at Self-service or knowledge base portal and integration

with other applications (like Google Analytic or social media) (Jadhav, 2016).

. Mobile accesspopularity of mobile devices made vendors

expanded beyond desktop-only access and began providing mobile SaaS apps that

could be accessed from smartphones, tablets or any other device with a browser.

All data in both desktop and mobile systems is typically auto-synced, which

helps run business from any place and any device with the internet access (Viswanathan,

2015).conclude, SaaS solutions priced on a subscription basis demonstrates a

number of strong advantages over traditional, On-Premise software deployments.

For both business and personal purposes, SaaS applications deliver modern

functionality and up-to-date capabilities that can satisfy any budget.

Attractive affordability and the familiarity of the web browser-like user

interface (UI) offered by SaaS solutions makes it more convenient for costumers

to run their businesses., there also exist strong deterrents for distribution

of cloud services and SaaS particularly. The major challenge which SaaS

developers face today is identity management and access control for enterprise

applications. Another point under contradictory debates among users is the

information security. Many companies who have never worked with clouds are

afraid to store their projects and client bases on the outsource servers

because of fear of violating private data. In their view, their own IT

departments which protect bases are more reliable than any other sided

provider.indeed, the security and privacy of data is a more developed point

that ordinary consumers think. This moment is not technical but psychological.

There exist various technologies to expand the role-based access to the cloud,

for example through a single access (single sign-on, SSO) technology. Nowadays,

the leading SaaS solutions provide multi-tiered security clearance which makes

keeping sensitive data completely safe (Singleton, 2011)., each of the big

players in the SaaS market tends to create its own technology of relationship

with the client to assure them in safety of data storage. For instance, Google

has a Secure Data Connector which creates an encrypted connection between

customer data and Google business applications and allows a client to control

which employees can access to Google Apps resources and which cannot. CRM

Salesforce provides similar functionality based on its own technology.exists a

comprehensive standard ISO 27001 which describes many aspects of information

security which can be confusing for customers. There is also another standard

ISO 27002 which can be interesting for service providers and customers which

describes the practical information security management. This standard can be

used in constructing the SaaS cloud, but in any case it is necessary to develop

specific standards for cloud computing.drawback of storing data in the SaaS

platform is its just online availability. It makes users depended on the

Internet and, in case of loss of access to the Internet, they lose access to

their data in SaaS applications.more problem that SaaS vendors face is that

there are users who are not ready to pay for software if they know how to get

this software illegally for free. But experts say that if the price corresponds

to the "painless" level, then users will probably not use illegal

tools like registration code generator or wares (note: wares are software

programs distributed illegally with copyright violation). But SaaS subscription

model in contrast to On-Premise reduce possibility to get a software illegally

as an access to personal online account can be received just after paying

subscription fee., taking into account all the concerns related to SaaS

solutions, that consumers have, SaaS developers should strive for a high level

of transparency of their services. They should give users a feeling of totally

safe and reliable storage of their data. The ideal model would be giving

options of aptitude install or export of all infrastructure and repository of

data created with this software. Moreover, the price should be set at the

reasonable level as the main concern for most of users when they choose SaaS

platform is to get more for a less price.

.2

SaaS in Russia: trends, problems and opportunities

the overview Cloud services in 2015 (CNews Analytics, 2015) a

detailed investigation of the recent trends on Russian IT market is conducted.

In the current part of our research we will use this overview as a reference to

study trends and problems which SaaS phenomenon face in Russia nowadays. This

will help us evaluate the potential significance and opportunities of SaaS

solutions for the Russian customers.first big Russian cloud computing projects

were launched in 2009. During 2011-2012, the development of the SaaS solutions

by Russian companies was targeted mainly on small and medium business. In 2013,

there were about 25 SaaS solutions prepared by Russian providers, and the main

part of them were projects adapted to the SaaS subscription model from the

traditional software model (PMR, 2015).recently, the situation on the SaaS

market in Russian has started improving a lot. Experts from Paralleles estimate

that during the last few years the share of SaaS in the cloud solutions sales

in Russia reached about 70% and in the segment of small and medium businesses

almost 90%. According to the experts from Russian Cloud Computing Professional

Association, the Russian SaaS market consists of nearly 200 high-quality

complex services for business users, whereas less than 30 young and ambitious

IT companies set trends in this sphere. Most of them are not even placed among

top-100 of the largest domestic IT companies but they successfully compete with

the world's leading producers of IT solutions (CNews Analytic, 2015).

Another analysis provided by

iKS-Consulting estimates the pace of growth of SaaS market to be around 25% in

2015-2018. The SaaS market is growing despite the fact that the Russian IT

industry is generally stagnating. According to CNews100 rating (2014), the

total revenue of 100 largest Russian IT companies increased slightly (+ 1%) in

RUB, but decreased by 15% in dollar terms. The figures published by

iKS-Consulting demonstrate also the proceeds from the cloud technologies in

Russia increased by 35% in 2014 comparing to the previous year. The biggest

part of this cloud revenue belongs to SaaS and makes up to 89% (the IaaS share

is 9%, PaaS - 2%) (Lebedev, 2015).

Speaking about economic situation in Russia, Olivier Caisson,

commercial director of Orange Business Services in Russia and CIS explains in

his interview to CNews why crisis provokes the increase of cloud solutions such

as SaaS (as well as PaaS, IaaS and others). In the crises time characterized by

uncertainty, businesses need maximum flexibility which can be achieved by using

cloud infrastructures. Another cloud trend on the Russian market announced by

Caisson is improving law regulation for personal data storage which stimulates

the development of local cloud market. Moreover, the Russian market has

enormous growth opportunities since for many customers cloud applications are

not yet an obvious solution. Comparing to Western Europe, the level of

outsourced managed services is still lower in Russia. But, referring to his

words, the situation is changing, and the number of companies that are

interested in transferring their resources to the cloud and shifting to the

outsourcing model is growing. Nevertheless, this process is still not

wide-spread and this approach to market strategy planning is not common (CNews,

2015).

Ilya Bublik, Head of Corporate

Business Automatization Department at SKB Kontur, thinks that combinations of

software and services will be widely discussed and popular: “Cloud services are

expanding and will go further. Exponential or close to it growth was shown by

MoeDelo, MoiSklad, bitrix24, amoCRM, Kontur.Bughalteria, Kontur.Elba,

Kontur.Diadok etc. I want to specify that this growth is not directly due to

the current environment: rub’s depreciation and import phase-out. Cloud

solutions are more convenient for small business in comparison with desktop solutions,

as they provide an access to the app from any spot in the world and from any

platforms - smartphone, tablet or stationary PC. Besides, cloud solutions

provide a lot of other, “unseen” for client, necessary things: data safety,

output capacity etc. In fact, the only thing that prevents the distribution of

the cloud - some kind of inertia of thinking” (Consulting, J’son &

Partners, 2015).

Another expert, a representative of Mango Telecom Alexey

Bessarabsky also admits the fact of migration companies to SaaS as it allows

them optimize costs, which is of high significance in crisis. "In crisis

due the weakness of the national currency, sanctions and other difficulties it

is less available to buy complex IT solutions which also stimulates the transition

to the cloud-based solutions. Thus, the crisis encourages companies to move to

SaaS-model” (Lebedev, 2015).is a strong opinion that SaaS applications are more

suitable for small and medium businesses and private users. But some experts

assure that large companies are willing even more to update their business

processes with “fashionable” solutions as they understand what benefits are

obtained when working with automation systems. That is why SaaS systems which

give the opportunity to add extra functionality to the existing infrastructure

look attractive for them. The problem is that big business is used to work with

large suppliers, but both of categories - big clients and big suppliers -

frequently are hostages of old corporate infrastructures and run bulky technologies

which are heavily invested and, thus, difficult to replace. While big companies

still utilize “heavy”, expensive traditional infrastructures, the global trend

of module infrastructure becomes more obvious for the “young” part of Russian

IT community. In opinion of Sergey Sobin, a head of the Workaud project,

"the paradigm of IT-technologies is changing". Rodion Repin, Managing

Partner of Million Agents agrees that “time of 'ponderous' decision-making has

passed; the world is moving towards more specific and easier solutions".

Turnkey SaaS solutions attract consumers with its in-depth knowledge of

business processes. Acquaintance with variety of services that developers offer

can become a source of business optimization ideas for a potential customer

(CNews Analytic, 2015)., young and creative SaaS developers who offer easy

turnkey solutions based on deep understanding of modern business processes get

more competitive advantages in winning big companies attention. Besides, young

companies who chose SaaS technology as a prime service from the very beginning

do not carry “burden of the past” and so do not need to rebuild their business

models. They spend more time to learn and develop their best solutions.the same

time, big IT companies who are turning now to SaaS subscription model have

another advantage: they use their well-established reputation and client base

to shift their software solutions from the On-Premise model to the subscription

one. Commercial Director of "IT Grad" Stanislav Mril, whose company

is rated among TOP 25 largest SaaS providers in Russia in 2015 points out that

the most profitable strategy is to sell SaaS-products from well-known brands,

which have already proven their efficiency as On-Premise software solutions:

"A truly explosive growth in SaaS deals comes from selling services which

are highly demanded as the "box" versions of the software products of

leading players in the business market (Microsoft, 1C, CommVault, ServiceNow,

etc.)" (Lebedev, 2015).to the ranking of the largest SaaS providers in

Russia in 2015 conducted by CNews Analytics (Application 2), due to the

peculiarities of Russian legislation one of the most demanded segments in SaaS

is Tax Accounting Services (SKB Kontur took the first place with the reported

revenue of 5.5 billion RUB). Among the leaders of SaaS solutions there are also

services of electronic trading, which do not have their foreign counterparts

(B2B company Center, which is engaged in the development of the electronic

trading service, won the third place in ranking with 1,16 billion RUB revenue).

The rest of the structure of SaaS the Russian market follows the trends of the

global market, where the greatest demand is demonstrated for the customer

relationships management systems (CRM). Among CRM products in the ranking there

are presented Western leading systems by such brands as Oracle, SAP, Microsoft,

as well as the solutions of the domestic companies (1C, Megaplan, amoCRM).

Another popular segment in the domestic SaaS market are communication and

collaboration platforms, particularly, the Cloud Private Branch Exchange (PBX).

There are two vendors in CNews SaaS ranking working in this field: they are

Mango Telecom with revenue of 1.35 billion RUB (2nd place) and

Telphin (318 million RUB, 7th place). "Now, a significant share

of SaaS solutions belongs to the Tax Accounting Services. But experts also

predict fast development of cloud-based solutions for remote collaboration and

communication. The main factors contributing to this growth are the dynamic

implementation of mobile devices, new formats of business with increasing

amount of distant working employees, the need to take quick decisions and, as a

result, real-time access to information from anywhere in the world”, says CEO

of Telphin Marina Turina (Lebedev, 2015). The ranked members showed different

dynamics of revenue. The turnover of the five participants has increased more

than twice: amoCRM (+ 193%), Cloud4Y (+ 124%), "IT Grad" (+ 114%),

"Business Projects" (+ 109%), "CIT Region" (+ 105%).leader

of Qsoft (amoCRM) Mikhail Tokovkin connects revenue growth with successful

positioning in the rapidly growing niche: "Although CRM systems have

already been around for a long time, many companies realize the value of

working with leads and customer base just now. amoCRM is very precisely focused

on this need and offers a simple and convenient solution".specialist of

Cloud4y company Eugene Bessonov links the success of his company with a crisis

and with the ability to adjust to the demands of the market at the right

moment: "The reasons of the interest can be, firstly, the reduction of IT

budgets, which cloud services are able to manage with, and, secondly, the

desire to reduce the risks of "idle" equipment. In addition, the

expansion of our business proposal up to 20 cloud services helped attract new

customers and increase an average invoice of old clients".about small and

medium business that often does not have capacity to deploy their own

infrastructure, it seems logical that SaaS is the best solution for them. But

SaaS developers note that small and medium business is a difficult audience. On

the one hand, the current economic situation is challenging for small and

medium companies. "In a crisis, entrepreneurs are not confident in the

future, the ability to manage without great investments in IT infrastructure is

especially attractive", says Sergey Maksimenko, CEO of GC "System

Technology". The limited budgets and the need for fast and powerful

solutions make SaaS technology a natural remedy for those who look for speed

and flexibility. SaaS applications are available at a price, they can be

quickly installed and connected, and they address specific business problems

and give immediate tangible results. Consumers may not have their own IT

professionals, and, actually, they do not need it. All expenses are included

into subscription price. But on the other hand, there is still not enough

knowledge, a basic understanding how to use the solution, how simple and

accessible it is., over the past few years, small and medium business has made

a big step forward. In the research Global and Russian SaaS-Solutions Markets

in B2B Segment (Consulting, J’son & Partners, 2015) there was made a

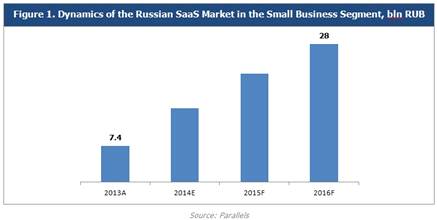

forecast that “Russian SaaS market in the small business segment will reach 28

bln RUB by 2016. Currently, the growth rates of SaaS market overstep the global

rates, according to the estimations of different analytical agencies”

(Application 3).are changing their attitudes and suppliers, in their turn, are

trying to optimize their proposals for small companies’ needs. Thus, for

instance, amoCRM company offers CRM package for small businesses for about 5000

RUB per month; for single users, it is possible “to get a place in the cloud”

in the accounting application for 500 RUB per month. The increased activity of

small businesses helps develop the technology. "Small and medium business

is more demanding: the service as well as the interface is very carefully

evaluated, and the feedback comes back quickly", Sergey Maksimenko says.

Developers have to prepare high-quality, understandable solutions so that all

kind of unexperienced users could implement them in their business processes.,

Russian SaaS providers sometimes still offer two different options of payment

for their software products. One of them is a traditional single payment for

On-Premise deployment with perpetual rights over software and another one is a

subscription model requiring recurring payments. This tendency demonstrates the

fact that not all the consumers yet are ready to use subscription as the only

way of acquiring software (excluding solutions which were designed as

subscriptions from the very beginning). In contrast, foreign SaaS providers

commonly employ just only the subscription model, even if their product was delivered

On-Premise in the past (like it was with Adobe, Microsoft Office, SAP,

Autodesk). Adobe can be the brightest example of a company who made this shift

not without difficulties connected with changing consumers thinking about

subscriptions. In 2011 the company announced its intention to shift from being

a company that sells software to one that rents it out. For the next three

years, the reaction of their clients was more than furious: from $833 million

in revenue in 2011 the company dropped down to $268 million in 2014. Even while

they were continuing to fall in their earnings, in 2013 Adobe announced that

there would be no newer releases of its perpetual Creative Suite. But over the

few next years their income finally has started growing again, and to end 2015

they expected to come with $3 billion in annual recurring revenue and with

approximately 5.9 million subscribers. But the point of success of this story

was value nurturing - giving consumers not the same product but under different

payment model but bringing value to their new experience: “The key was not just

transforming the price and how people paid us. We needed a product that was

materially different, a whole new product”, admitted Mark Garrett, Adobe’s CFO

(McCann, 2015).example shows that subscription is not always the customer’s

preferred model. For many customers the traditional license model is still

relevant, and in spite of the increasing popularity of the subscription

approaches it will continue to be so especially when speaking about such

developing markets as the Russian one.up, it is possible to claim that SaaS

market is the largest segment on the cloud services market in general, and the

interest to use such type of cloud solutions is constantly increasing in Russia

due to the opportunity to reduce the capital costs by replacing them on

operational. One of the central factor that can deter the choice of SaaS is

mistrust to information security of stored data connected with inertia of

thinking rather than with real situation.

.3 Predicted impact of SaaS subscription model on the

Russian business landscape

digital solutions expansion over the globe is a fast

developing trend and SaaS is believed to be a driving force behind this

digitalization. We use SaaS far more often than we think. SaaS solutions are

all around persistently convincing us in their convenience, simplicity and

efficiency. As SaaS Addict writer Omri Erel says, “SaaS will be everything and

everywhere, in a way that allows us to share information, intelligence, insights

and opinions at all times.” (Harvey, 2016)intimacy between SaaS companies and

their customers has increased after the fast rise of the subscription economy.

The subscription economy turns relationships of companies with customers into

more direct, responsive, complex and multi-channel. Customers become certainly

a key part of this relationships and companies rather than spotlighting product

itself or transaction as a central point of their business, should live with

the idea how bring value to customers. The main focus in the formula for growth

should be on monetizing long-term relationships instead of shipping

products.all above as a fundamental base of the SaaS subscription model, we can

consider the impact of SaaS on Russian business landscape from two perspectives:

this can be impact on companies who are clients of SaaS providers, and on SaaS

providers as they are representatives of business landscape as well., the

predictable consequences of wide use of SaaS solutions can lead to a scenario

where companies become more focused on their own business specialization and so

the efficiency of their work increases as more time is dedicated to specific

business tasks. This common productivity grow will healthfully influence

Russian economy in general bringing more professional services in all kind of

industries., SMB companies which do not have enough industrial resources and

finances to complete different tasks not predominant for their business,

putting a part of their responsibility on SaaS providers, finally, get equal

opportunities on the market to become competitively attractive in their niche

as they use help of professionals with huge experience when working on their

projects.from a SaaS companies’ perspective, the possible impact of

implementing the SaaS subscription model into their business is vastly big.

First of all, as it was reported in the various researches used in our paper,

the pace of growth of Russian SaaS market is increasing and estimated to be

around 25% in 2015-2018 despite the fact that Russian IT industry is suffering

from crises. That means that SaaS solutions will only grow in their

attractiveness gaining the biggest share among cloud services and becoming

highly popular than ever before. One of the reason of this rapid grow can be

“fast” channels of communication which are indispensable part of the

subscription model. Being so close to clients feedback motivates providers to

develop and update their software quicker, better and further in order to keep

their customers satisfied and renewing their subscriptions. This positive

influence of new communication standards which force providers improve their

services encourages high-speed progress of Russian SaaS market in general.,

SaaS companies worldwide, and particularly in Russia, are gaining reputation of

an expert community: their experience is based on countless cases of improving

business efficiency, they conduct diverse researches and collect extensive

library of analytic data which help them provide better solutions for

businesses of any industry. Moreover, they use these analytics not just to

develop their own solutions, but also to share their wide experience with their

audience in their blogs, forums, webinars. Some SaaS companies offer

educational courses prepared by their experts, arrange presentations and

workshops for partner universities and business organizations. Partly, it is a

result of the value nurturing approach which suggests that clients do not want

just to get a product, they want to get some value when they acquire this product,

and new knowledge is a kind of universal value which SaaS companies bring to

society (Janzer, 2015). Thus, SaaS companies can be considered as a source of

highly useful information with their reliable data and practical tips.possible

negative consequence of the universal penetration of SaaS subscription

applications to solve business tasks is about reaching the saturation point

when there will be too many online subscriptions which will be hard to manage.

But in Russia the trend of applying SaaS solutions into business workflow is

just rising and it is too early to anticipate this downturn.

Chapter

3. Real scenarios of SaaS infrastructures and applications

.1

SaaS Subscription businesses: comparison of foreign and Russian cases

, since the basic principles and key features of the SaaS

subscription models are explored, and strong and weak sides of this phenomenon

in the contest of the Russian business landscape are found out, the empirical

study of the real SaaS infrastructures and applications scenarios should be

conducted to approbate the theoretical theses of this research.the empirical

part of the paper we use the case study method to provide a three-stage

research. This method is applied to reconstruct the cases of implementation the

SaaS subscription model in Russian and foreign software companies by collecting

detailed descriptive data qualitative in nature.

The flow of the case studystage. Preparation

In the first part of the research, we made a choice of 16

SaaS applications based on the following restrictions:

) The selection includes 8 Russian SaaS applications with

the subscription business model;

2) The selection includes 8 foreign SaaS applications

with the subscription business model;

) The selection is random and includes applications by

companies of different size, degree of popularity, and market share;

) The selection is restricted with the applications

with corporate clients which employ these solutions for business purposes (B2B

segmentation);

) The chosen applications have 3 and more reviews each

published in the leading business software review platforms.

For this purpose, we used the next leading business software

review platforms:

) G2Growd - “the world’s leading business software review

platform, leveraging its 70,000+ user reviews read by nearly 600,000 software

buyers” (G2Growd);

2) GetApp - “the leading premium business app discovery

platform on the web. The site focuses on profiling established business apps -

mostly software as a service (SaaS) - targeting an audience of small and

medium-sized businesses and business buyers from enterprise departments” (Nubera);

) StartPack - “Comparison system for cloud services

performance and reviews, which helps find cloud integrators with specified criteria”

(StartPack).

As a result, we pointed out the next companies for our case

study:

|

Russian applications

|

|

Foreign applications

|

|

|

Solution

|

Category

|

Solution

|

Category

|

|

Kontur Elba

|

Accounting

|

Xero

|

Accounting

|

|

CRM Simple business

|

Business management system

|

Zoho CRM

|

Business management system

|

|

Megaplan

|

Business management system

|

Basecamp

|

Business management system

|

|

Bitrix24

|

Collaboration&Productivity

|

Wrike

|

Collaboration&Productivity

|

|

Worksection

|

Collaboration&Productivity

|

Evernote

|

Content&Document managemnt

|

|

Mango Office

|

Business communications

|

Aircall

|

Business communications

|

|

PlanFix

|

Temwork management

|

Microsoft Office 365

|

Office suits

|

|

amoCRM

|

CRM and transactions system

|

Adobe Creative Cloud

|

Digital media

|

next step of the research was to define characteristics

relying on which we could collect qualitative data and describe the chosen

solutions within unified systematic approach. With this aim, we have compiled a

set of features that illustrated the applications from the communication

perspective: these features represented how applications involve clients into

communication processes, how they support relations, which channels of

communication they take advantage of and others. These set of features was based

on the deep analysis of the reviews left by clients on the G2Growd, GetApp and

StartPack review platforms. We observed a vast range of both positive and

negative feedback (Application 5) and selected the points of view related to

the issue and of the highest concern for clients. Consequently, there was

designed the following original worksheet:

1) SaaS Solution;

2) Category;

) Business model;

) Key idea;

) Landing Page (Official Site):

· Simplicity;

· Usability;

· Utility;

6) Call to action button;

7) Service Features;

) Promotions;

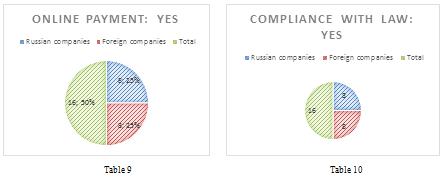

) Compliance with law;

) Security and privacy;

) Data backup;

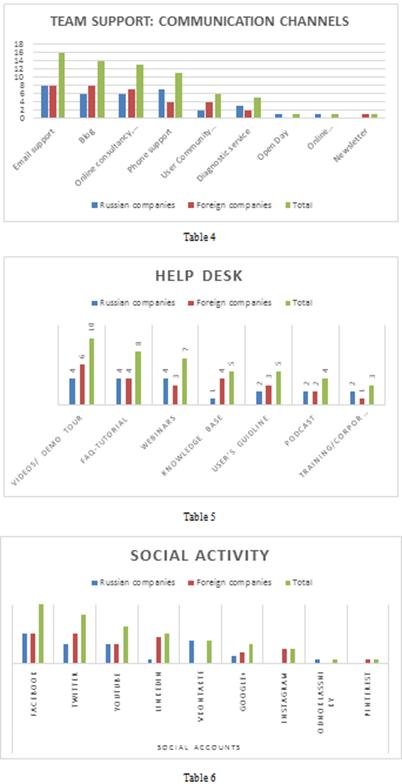

) Team support: communication channels;

) Social accounts;

) Help Desk;

) Partnership programs;

) Online payment;

) Mobile app;

) Integration with popular cloud services and

applications;

) User interface;

) Installation and customization;

) Crossplatform solution;

) Trial access;

) Free access with limited options;

) Gamification;

) Additional extensions (applications);

) English language;

) Company ideology.

All companies’ profiles are available at Application 4

Second Stage. Trends analysis

The main aim of the second stage of our research was to

analyze gathered data and pick out the most significant trends. To assist this

process, we introduced measurement scales for each feature and counted

quantitative data where it was possible. All the information was examined from

three dimensions: they are “Russian cases”, “Foreign cases” and “Total”.

First, we examined the clients’ feedback from the leading

business software review platforms (G2Growd, GetApp, StartPack). As a result,

the following trends were differentiated:

1) Clients put high expectation on the Customer Support

service of the SaaS applications: the most appreciated characteristics are

quick expert help, efficiency of responds and client oriented individual

approach;

2) Clients value the service security;

) Clients want applications being easy to understand,

to install and customize;

) Correct ideology earns big attention;

) Convenience of an application should go along with

simplicity and wide set of features;

) Design of application matters as well as intuitive

operation interface;

) Mobile version is a strongly desirable option;

) Regular updates should happen regularly but without

disturbing clients from business workflow;

) An application is expected to be flexible to fit any

needs;

) Clients read corporate blogs and Knowledge Base of

SaaS providers looking for educational tips how to operate the system;

) The product is expected to be cost-effective;

) Clients value most of all that applications make

their life easier and more professional, and help bring a team together.

) Clients want their applications being integrated

with many other useful cloud solutions;

) The idea of paying a monthly cost and always having

the most up-to-date software as opposed to paying a large up seems attractive

to most of users.

As we can see, the trends above prove the theoretical aspects

of SaaS subscription model covered in our research in the Chapter 2., we

studied the data from companies’ worksheets designed at the first stage of our

research and pulled out the next tendencies which companies demonstrate:

) Foreign companies typically stop employing On-Premise

model for selling their solutions, using the subscription model as the only way

to deliver their SaaS solutions; in contrast, one third of the Russian software

companies are still using On-Premise strategy together with the subscription

model (Application 6, table 1);

2) Among Russian companies it is typical to use monthly

subscription model whereas foreign companies offer their clients both monthly

and annual subscription plans (Application 6, table 2);

) Foreign SaaS providers put more attention on making

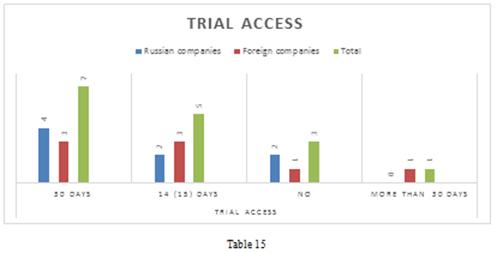

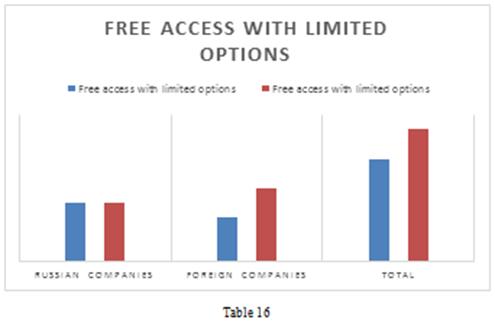

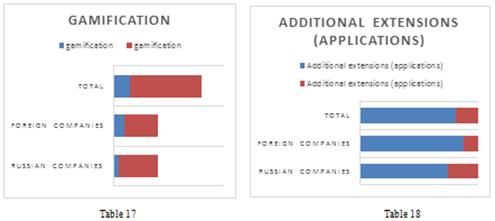

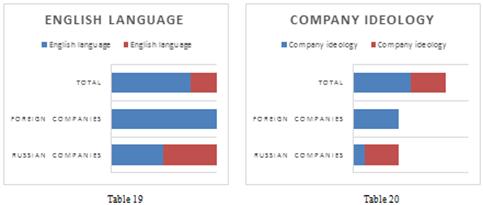

their sites both simple and useful for their clients: all the indicators -