How competitive is Russian economy?

How

competitive is Russian economy?

Introduction

Russian economy has been studied by numerous

international organizations, academics, and other analysts. And consequently

there are strongly divergent views about the state of Russian competitiveness.

Strong economic growth, fiscal surpluses, and reforms in some areas of the

business environment are compared with huge continuing challenges in doing

business in Russia as well as rising government intervention in the market,

especially in energy. This mixed evidence has been interpreted very

differently. Within Russia (including many foreign companies operating in the

country), there is optimism about the progress of the nation’s economy. Outside

of Russia, there is deep scepticism about whether the current economic success

of Russia extends beyond high oil prices, and whether the increasing

concentration of economic (and political) power in the central government has

changed the course of Russia’s reforms for the worse. There is some truth in

each of these perspectives, but a deeper analysis is needed to truly understand

where Russia stands and to guide future policy.

In this coursework it will be proved that modern

Russia has no inherent reason for not entering a period of high and sustained

growth and that it can join the ranks of the most competitive economies in the

world in the near future.

The coursework is organized in three sections.

First, the assessment of Russia’s current competitiveness is presented,

highlighting the roles of the country’s legacy, its broad economic context,

microeconomic conditions, and current market structure. Second, the evaluation

of Russia’s economic performance on micro level is introduced with description

of current market structure's effect on business environment. This part also

introduces overall performance assessment. Third, the competitiveness of

Russian economy on the global arena is presented and broadly evaluated.

1. Theoretical background to the market structure and

competition

1.1 Concept of competitiveness and competition

endowment

russian economy

Competitiveness can be

defined at the firm level, the industry level, and the national level. At the

firm level, competitiveness is the ability to provide products and services

more effectively and efficiently than relevant competitors. This includes sustained

success in international markets without protection or subsidies.the industry

level, competitiveness is the ability of the nation’s firms to achieve

sustained success versus foreign competitors, without protection or

subsidies.the national level, competitiveness means the citizens’ ability to

achieve a high, and constantly rising, standard of living. In most countries,

the standard of living is determined by productivity, which deploys national

resources and the output of the economy per unit of labour and/or capital

employed.

Competition in economics is the rivalry

between two or more businesses to gain as much of the total market sales or

customer acceptance as possible. It helps to maintain reasonable prices,

provides consumers with new and improved products, forces businesses to operate

efficiently and results in a wide selection of products from which to choose.was described

by Adam Smith in The Wealth of Nations (1776) and later economists as

allocating productive resources to their most highly-valued uses and

encouraging efficiency. Smith and other classical economists before Cournot

were referring to price and non-price rivalry among producers to sell their

goods on best terms by bidding of buyers, not necessarily to a large number of

sellers nor to a market in final equilibrium.microeconomic theory distinguished

between perfect competition and imperfect competition, concluding that no

system of resource allocation is more Pareto efficient than perfect

competition. Competition, according to the theory, causes commercial firms to

develop new products, services and technologies, which would give consumers

greater selection and better products. The greater selection typically causes

lower prices for the products, compared to what the price would be if there was

no competition (monopoly) or little competition (oligopoly).

1.2 Models of Competition

classify markets according to conditions that

prevail in them. They determine market structure, or the nature and degree of

competition among firms operating in the same market. Economists have names for

these different market structures. They are Pure Competition, Monopolistic

Competition, Monopoly and Oligopoly.

Pure Competition

Pure competition is a

market scenario that includes a large number of autonomous and knowledgeable

buyers and sellers of an identical product. Yet none of which are capable of

influencing the price. There are five major conditions, which characterize

purely competitive markets.

1. There are a

large number of buyers and sellers. No single buyer or seller is large enough

or powerful enough to affect the price of the product.

2. Buyers and

sellers deal with identical products. Therefore buyers do not prefer one

seller's merchandise over another's because there is no brand names, and no need

to advertise.

. Each buyer and

seller acts autonomously, there must be no collusion. If such a situation

occurs, sellers would compete against one another for the consumer's dollar.

Buyers also compete against each other and against the seller to obtain the

best price.

. The buyers and

sellers are knowledgeable about the items for sale. Because all products are

exactly the same, customers would have little reason to remain loyal to one

seller.

. The buyers and

sellers are free to get into, conduct, and get out of business; thus making it

difficult for a single producer to keep the market just to itself.

Monopolistic Competition

Since we live in a

society where the five elements of pure competition are not available to us,

then we are clearly operating in a state other than pure competition. Instead

we operate under a different model of competition known as monopolistic

competition. Any time the elements of pure competition are not met the existing

model is monopolistic competition.fundamental difference between a pure

competitor and a monopolistic competitor is that the latter refrains from

selling identical products. By employing product differentiation, the

monopolistic competitor is trying to establish a comparison between its product

and another competitor’s product.

Oligopoly - a few large

sellers dominate and have the ability to affect prices in the industry. Because

of the fact that in an oligopoly there are very few firms, whenever one firm

does something, the others follow suit. Since all the firms have considerable

power and influence, firms tend to act together. There are times when the

interdependent behaviour of the firms results in a formal agreement to set

prices; this is termed «collusion». Price-fixing, a type of collusion, is the

action taken by an oligopoly to charge the same or similar prices for a

product. The firms must also agree to divide the market so that each is

guaranteed to sell a certain amount. Yet collusion is against the law because

it restrains trade. Price wars are also common in oligopolies. When one firm

lowers prices, it leads to a series of price cuts by all producers that may

lead to unusually low prices in the industry. Raising prices is also risky

unless the firm knows that rivals will follow suit. Otherwise, the higher priced

firm will lose out on sales. An example might be Coca Cola and Pepsi which

dominate the soft drink market.

Pure Monopoly exists when a

specific person or enterprise is the only supplier of a particular commodity.

Thus, the main characteristics of monopoly include profit maximizing

orientation; a monopolistic enterprise decides the price of the good or product

to be sold; there are tough barriers to entry - other sellers are unable to

enter the market of the monopoly. As in a monopoly there is one seller of the

good which produces all the output, the whole market is being served by a

single company, and for practical purposes, the company is the same as the

industry. A monopolist can change the price and quality of the product. He

sells more quantities charging fewer prices for the product in a very elastic

market and sells less quantities charging high price in a less elastic market.

1.3 Russia’s endowment

faces complex endowments that create unusual

challenges for competitiveness. These challenges-some of them unique to Russia

given its recent history while others which are typical for many countries at

this stage of development-must be confronted head on in economic

strategy. Otherwise the performance of the country will remain below its

potential and the political sustainability of economic reforms will suffer.

Russia’s history as a planned economy left the

country with an economic legacy that still reflects political

decisions instead of economic efficiency1.

Companies grew up at locations that were

determined according to political and security considerations - not by the

concept of the efficient economic geography. Company units were often too

large in terms of productive capacities at a given stage of the value chain,

but too small in terms of presence and capability across the value chain.and with

it demand patterns also reflected political decisions, not individual choices. With

citizens strongly influenced to live in the far north and east as well as in rural regions

and smaller cities, a substantial population reallocation was inevitable2. Greater

urbanization has important potential economic and social benefits for Russia,

but

the

transition will be painful.’s Soviet past, however, left the country with

important assets that it can build upon. The general skill level of the

population is high, and education is held in high respect. The science

system consists of a large number of research institutions employing a significant

number of highly educated scientists and engineers, especially in natural sciences and

technologies related to military uses. The basic physical infrastructure of the country also

provided a good base to build upon, though it is now increasing inadequate.,

Russia’s early steps towards economic reforms, especially the privatizations

of the mid-1990s, has left the population with a deeply cynical and biased view of the

market economy. In Russia, the market economy has become associated with private

monopoly, not competition.ownership and wealth are seen as the result of political

connections and criminal behaviour, not entrepreneurship and value creation.

This is one of the reasons why the population is strongly in favour of

government actions that intervene and reign into the power of business.

Unfortunately, there is little public support or pressure for the government to

create more room for private entrepreneurship or ensure equal treatment

of all companies.

Geography

Russia’s huge geographic area creates the need

for effective regional governance structures to improve the business environment at

lower levels of geography.’s location between Europe and Asia puts it in a

potentially beneficial position alongside major trade routes. However, the

inaccessibility of Russia as a transit country in the past and the

weaknesses in its current business environment has left this opportunity

untouched. Most global trade flows are far away from Russia. Russia is also a country with

only a limited share of its population in coastal regions that could easily connect to the

global economy.’s neighbours are largely former Communist countries that share

many of the same challenges that Russia is facing now. But Russia also borders

to the European Union (through borders with Finland, the Batiks, and - through

Kaliningrad - Poland) and China; countries offering interesting economic

opportunities if Russia can take advantage of them. So far,

relationships with neighbours have been mostly negative instead of seeking opportunities

for win-win economic collaboration.

Natural Resources

Russia’s significant natural resource wealth has

facilitated rapid wealth extraction but created political and

economic challenges. Russia’s oil exports per capita were at $935 in 2005, and oil

production per capita at about $12903.has proven reserves of about 74m barrels

oil (6.5% of total global reserves) and 48trill m2 natural gas (equivalent to 300m barrels

oil; 26.7% of total global reserves),4 and these reserves

represent an annual value of $3,900 per capita for the next 50 years assuming an

average oil price of $75 and a stable population.level of resource wealth is

substantial, and has fuelled a boom since 2000. However, even this

level of resources will not itself make Russia a wealthy country.the same time, economic

volatility, due to unpredictable changes in world commodity prices and upward

pressure on the real exchange rate, can easily undermine business investment

and

the

emergence of a vibrant private sector outside of natural resources., natural resource

wealth of this size creates huge incentives to capture and utilize the power

and

wealth

that resource abundance provides, putting pressure on Russia’s fragile

political structures and government institutions.

2. Russia’s microeconomic environment

2.1 Engendered structural dominance

the national level, the

degree of concentration of industrial output in Russia does not indicate that

the lack of competition is a structural problem. The four-firm concentration

ratio5 many industries averages about 60 percent, which is similar

to that in the United States, and the largest Russian manufacturing enterprises

(measured by number of employees) are not unusually large, compared with U.S.

firms. However, this analysis of structural dominance masks three underlying

attributes of Russia's industrial landscape., large Russian enterprises tend to

be organized as single, integrated, multiplant establishments often located in

or near the same city, whereas enterprises in industrial countries usually have

multiple establishments at several different locations domestically and, often,

abroad as well. Thus, the establishments of the largest Russian enterprises

are, on average, significantly larger (in terms of number of employees) than

their counterparts in other countries, including the United States. Although the

existing level of horizontal integration in Russian manufacturing is largely a

legacy of Soviet central planning, such integration appears to be increasing.

The increase is due not to new corporate expansion, however, but to mergers and

acquisitions., many of the dominant enterprises in Russia are also highly

vertically integrated (or have exclusive buyer-seller relationships). To be

sure, putting successive stages of production under one corporate roof can

result in economies of scale and reduce transaction costs. But in most

industries, such vertical efficiencies exist only up to a certain point.

Indeed, in many product markets throughout the world, it is increasingly

cheaper for a firm to buy inputs (or sell outputs) on the open market than to

produce them internally.Russia, because the enforceability of contracts still

cannot be taken for granted, there are strong incentives for vertical

integration. The uncertainties and chronic shortages of the old Soviet supply

system encouraged a high degree of vertical integration, which has persisted,

in part, because of inertia. Moreover, vertical integration, like horizontal

dominance, is increasing-again, usually through mergers and acquisitions rather

than expansion. Importantly, excessive vertical integration superimposed on

horizontally concentrated product markets can hinder the entry of rival firms.,

significant political and economic power is wielded by regional authorities in

Russia, a feature of other large transition economies, such as China. This is evident

in the tight control of important economic activities within a region. Such

control, in combination with vertical integration, helps freeze the high degree

of structural autarky that appeared under the Soviet system, when producing

consumer goods was a local responsibility and enterprises served only local

markets. Worse, it strengthens administrative-as opposed to economic-geographic

market boundaries and fosters the regional segmentation of the Russian economy,

hampering the establishment of a unified economic space, strong interregional

competition, and natural economies of scale.

Local authorities engage in a variety of

practices to limit the interregional movement of goods and services, including

charging duties on the «import» or «export» of certain alcoholic beverages;

maintaining regional price controls on some agricultural products; imposing

registration fees on workers from other regions; granting tax or credit

preferences to support the building of local «business champions»; and

supporting arbitrarily exclusive licensing. In this regard, it is telling that

in recent years some of the most frequent violations dealt with by the Ministry

of Antimonopoly Policy and Support for Entrepreneurship have been

anticompetitive actions by local governments.

.2 Russian economic performance

most important single element explaining a

country’s medium-term growth performance is productivity. While economic growth

can be based on many sources, for example capital accumulation or population

growth, it is sustainable only if complemented by an increase in productivity.

With a GDP per capita of US$10,521 in 2010 (international $15,806 in purchasing

parity terms), over the 2000-09 period Russia achieved a relatively high GDP

growth rate of 5.5 percent, which put the country on the path toward

convergence with Organisation for Economic Co-operation and Development (OECD)

levels (see Figure 1).

Figure 1: Russia GDP Growth Rate

, despite this positive development over the past

decade, the gap between Russia and OECD economies in terms of GDP per capita

remains sizeable, amounting to about 47 percent.some structural factors-such as

demography, the employment structure, and above all the number of hours worked

per person-contribute to closing the gap, the large difference in prosperity

can be clearly attributed to differences in labour productivity (see Figure 2).

Figure 2:Disaggregation of difference in

GDP per capita in the Russian Federation and the OECD, 2010

Indeed, Russia’s solid GDP growth over the past

decades has been accompanied by growing productivity. In transition economies,

productivity growth is often a reflection of increasing capacity utilization;

this is also the case in Russia., after correcting for capacity utilization,

out of the 6.5 percent growth achieved on average during 1999-2005, about 4.15

percent was attributable to gains from resources that were used6.of

this growth in productivity has been the result of efficiency gains within

sectors rather than reallocation among sectors. Overall, productivity growth

that took place within the firms-that is, growth that occurred through greater

efficiency in production processes, the shedding of surplus labour in the

course of the privatization process, and better organization of administrative

functions-explains the largest share of efficiency gains, accounting for about

30 percent of total manufacturing productivity growth from 2001 to 2004.2 Much

of this was a result of labour shedding in the initial transition period.the

shrinking of the manufacturing sectors is a process that most transition

economies have undergone, the decline of Russian manufacturing beyond the

initial transition period remains a worrying trend for a number of reasons.most

important is that, while the number of jobs in manufacturing is declining,

employment in the government sector is growing, pointing to a move toward a

growing role of the state that is built on the redistribution of resources

rather than creation of value. Furthermore, the Russian Federation is well

positioned to be competitive in high-end manufacturing sectors. It could aim at

improving the business environment and creating favourable conditions for the

development of these industries.number of studies show that the decline in

manufacturing competitiveness in Russia is due to the combination of an

increase in real wages and shortcomings of the business climate7, which puts

Russia at a disadvantage in international comparison.productivity in the

country is higher than in India and China, high Russian salaries mean that for

each dollar of wage, a Russian worker produces half the output of his or her

Chinese or Indian peers. Competitiveness enhancing reforms will improve the

business environment, strengthen efficiency, and align manufacturing

productivity better with international wage-productivity ratios. This will make

Russia more attractive as an exporter of goods and tradable services as well as

a destination for foreign direct investment (FDI).

3. Global competitiveness assertion

3.1 The state of Russian competitiveness according to the Global

Competitiveness Index

ranks 66rd out of 139 countries covered by the

GCI 2010-2011 (See figure 3). The country lags behind the OECD member countries

on average (on a scale of 1 to 7, Russia achieves a score of 4.2 against 4.9

for the OECD) as well as the BIC economies (score of 4.5)8. The

country remains stable compared to the previous year, keeping the same rank.,

in the course of the past five years, Russia’s performance in the GCI stagnated

and the country remained in the 5th deciles of the GCI sample. A considerable

improvement was observed prior to the financial crisis (in the 2008-09

edition), although it deteriorated the following year.the challenges that

Russia will have to address in order to raise productivity are above all the

poorly functioning institutional framework, as it belongs to both public as

well as private institutions.addition, competition and demand conditions do not

contribute to the efficiency of goods markets to the same degree as in OECD and

BIC economies. Furthermore, financial markets trail the two comparator groups

in terms of efficiency as well as trustworthiness and confidence.but not least,

the country’s business sector is significantly less sophisticated than

enterprises in peer economies or OECD member states. The following sections of

the chapter explore in more detail the competitive strengths and weaknesses of

the Russian Federation identified by the GCI analysis as the key areas for

policy reform.can be summarized in a simple «three-plus-five formula» -

building on three strengths and addressing five priority challenges, the

Russian Federation could reap considerable productivity gains. Improvements in

these five areas by 2030 would lead to improved competitiveness by this time,

which would correspond to a significant increase in prosperity in Russia.

3.2 Russian growth in detail: exploring performance at the industry

level

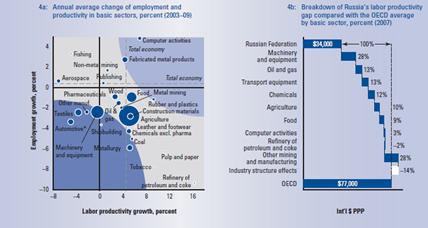

productivity gap between Russia and the OECD

countries is determined by the level of productivity in individual industries

and the variation in industry structure. When we take a closer look at the

industry structure, three groups of industry sectors can be determined: basic,

supporting, and infrastructure sectors.sectors are agriculture, mining,

manufacturing, and software development-that is, those industries that produce

goods that are traded globally and therefore often face real competition. Supporting

sectors are the market sectors that either facilitate the distribution of goods

(such as wholesale and retail trade), support production (for example, business

services), or produce goods and services that can be traded only locally

(construction, real estate, hospitality, etc.). Infrastructure sectors are

non-market services and production, such as government services, education and

health, utilities, transport, and communications9.to explore growth

in the Russian economy between 2003 and 2009 according to sector groups, the

analysis shows that growth was higher in those sectors with a greater intensity

of competition (Figure 4). Productivity in supporting sectors (which are mostly

market services) grew faster than in many basic sectors (where the government

is the main proponent and owner) and in most infrastructure sectors (which are

non-market services). In basic sectors-both manufacturing and

resources-productivity grew moderately while employment declined.

Infrastructure sectors did not grow in employment, while productivity grew

slowly.

Figure 4: Productivity and employment

growth; source: Global Competitiveness Report 2011-2012

, infrastructure productivity in Russia was three

times lower than it was in OECD countries. In recent years, productivity growth

has not been realized in Russian infrastructure sectors. Furthermore, the

government share in total employment was constantly growing (Figure 5).

Figure 5: Productivity and employment in

infrastructure sectors; Source: Global Competitiveness Report 2011-2012

transformation is not occurring in any

infrastructure sector, and such fundamental change is essential for further

development of these sectors.sectors were fast growing in both productivity and

employment, with finance leading the growth (Figure 6). This sector has been,

and is still, emerging and its growth fills an «empty space» and promotes the

underdeveloped distribution function in the economy. The productivity gap in

supporting sectors remains large (47 percent of the total gap) and further

rapid growth is necessary for productivity improvements. More than half of this

gap is determined by low productivity in the labor-intensive construction and

real estate sectors. Productivity is gradually improving there but many

problems still persist.basic producing sectors in Russia demonstrated some

growth in productivity and decline in employment (Figure 8). Resource sectors

raise productivity but do not create net new jobs. Among the manufacturing

(including software) sectors, the best performing were computer activities,

fabricated metal products, and rubber and plastic.

Figure 7: Employment and productivity in

basic sectors; Source: Global Competitiveness Report 2011-2012

also grew rapidly in oil and gas refinery,

metallurgy, coal mining, food processing, chemicals (except pharmaceuticals),

tobacco, and pulp and paper. Most of these are characterized by intensive

market competition.machinery, equipment, and transport equipment, both

employment and productivity decreased. These sectors were the most seriously

affected by the economic crisis of 2008-09. The government is the most

important player in these industries.

Productivity gaps in machinery and equipment and

transport equipment account for 40 percent of the total productivity gap

between basic sectors in Russia and those of the OECD countries. Another 40

percent is the result of lower productivity in the oil and gas, mining and

refinery, chemicals, and agriculture and food sectors.are different

perspectives on the development of basic sectors. Some experts propose

abandoning manufacturing and instead using natural resource rents for the

development of sophisticated market services; others insist that industry

development, especially manufacturing, should be the highest priority.

Statistics and cross country analysis, however, show that the truth is

somewhere in the middle: manufacturing still matters for economic development

and countries create new jobs in competence-driven manufacturing.to statistics,

as countries proceed to the next stages of development, per capita

manufacturing value-added increases. This is proportional to per capita GDP.

Although it is well known that the employment share in industry tends to

decrease after some critical point, the employment decline is compensated by

productivity gains. These gains include both an increase in productivity at the

individual industry level and the shift up the value chain to sectors that

depend less on natural resources and are more competence based.

3.3 Place in the world

Russian Federation drops three

ranks to 66th position this year10. The drop reflects the fact that

an improvement in macroeconomic stability was outweighed by deterioration in

other areas, notably the quality of institutions, labour market efficiency,

business sophistication, and innovation. The lack of progress with respect to

the institutional framework is of particular concern, as this area is likely to

be among the most significant constraints to Russia’s competitiveness.the rule

of law and the protection of property rights, improving the functioning of the

judiciary, and raising security levels across the country would greatly benefit

the economy and would provide for spill over effects into other areas. In

addition to its weak institutional framework, Russia’s competitiveness remains

negatively affected by the low efficiency of its goods market. Competition,

both domestic as well as foreign, is stifled by market structures dominated by

a few large firms, inefficient anti-monopoly policies, and restrictions on

trade and foreign ownership.despite many efforts, its financial markets remain

unstable, with banks assessed very poorly (129th). Taken together, these

challenges reduce the country’s ability to take advantage of some of its

strengths-particularly its high innovation potential (38th for capacity for

innovation), its large and growing market size (8th), and its solid performance

in higher education and training (27th for the quantity of education)11.

The full information may be found in the Appendix 1., there is no doubt that

Russia is a country of great-and unrealized-potential. But despite its

well-educated population, the abundance of its natural resources and its

favourable geographical location it has not yet grown at the same pace as many other

emerging markets.

Conclusion

was proved that there is no inherent reason why

the Russian economy could not enter a period of high, sustained growth in

coming years. It has a number of structural features which create the

conditions for rapid growth: it is likely to benefit from gains in efficiency

associated with the continued elimination of remaining distortions from its

central planning past; it has an impressive natural resource endowment which is

likely to stimulate continued and growing interest among foreign investors,

particularly in the all-important energy sector. The human capital stock is on

balance, a competitive advantage, and remaining skills shortages-while sharply

limiting in many ways in the public sector-are gradually being addressed.has an

impressive tradition of world-class research in the basic sciences, including

seminal contributions to mathematics and physics. But the brain drain has been

a blow to the country’s ability to quickly move back to the outer limits of the

technology frontier. The basic machinery to do so, in the form of higher

education establishments that support scientific research, and the commitment

to excellence that was the distinguishing feature of Russian culture and

science during much of the past century will have to be revitalized.conditions

in the global oil markets suggest that the external environment is likely to

remain favourable to Russia, creating an ideal opportunity to push ahead with

structural and institutional reforms. The alternative is to pursue these in the

middle of an economic downturn or a crisis, a scenario that is traditionally

more difficult.IMF is certainly correct in suggesting that a loosening of

fiscal policy-particularly one aimed at boosting public sector wages and

pensions, not investments in education, public health, and infrastructure, all

of which would boost productivity and thus enhance the permissible level of

real appreciation of the rubble-will «strengthen tensions between exchange rate

and inflation objectives.»beyond these issues, it is put on the authorities to

broaden their focus, and deal with a broad range of emerging stresses. Foremost

among these are how to arrest the disturbing demographic trends, how to better

utilize surplus public resources to enhance the economy’s capacity for

innovation, and how to put the country back on a path of world-class scientific

and technological achievement, so that Russia may join the ranks of the most

competitive economies in the world.

Bibliography

1. Ahrend, Jurgen (2004), Accounting for Russia’s Post-Crisis

Growth, Economics Department Working Paper No. 404, ECO/WKP(2004)

27, OECD: Paris.

2. Aslund, Anders (2006), The Hunt for Russia’s Riches, Foreign

Policy, January/February

2006, pp. 42 - 48.

. Balakrishnan, R., S. Danninger, S. Elekdag, and I. Tytell.

2009. «The Transmission of Financial Stress from Advanced to Emerging

Economies.» IMF Working Paper No. WP/09/133, June. Washington DC: IMF.

. Broadman, H.G. (2000). «Reducing Structural Dominance and

Entry barriers in Russian Industry,» The Review of Industrial Organization (in

press).

5. Brown, A. and Brown, J. (1998) «Does Market Structure

Matter? New Evidence from Russia,» mimeo, Western Michigan University.

. Competitiveness at the Crossroads: Choosing the Future

Direction of the Russian Economy, by Michael E. Porter and Christian Ketels,

with Mercedes Delgado and Richard Bryden

7. Desai, R.M. 2008. «Improving the Investment Climate.» In Can

Russia Compete? ed. R.M. Desai and I. Goldberg. Washington DC: Brookings

Institution Press. 91-121.

. Dezhina, Irina (2005), Reform of Federally Funded Research

and Development, Problems of Economic Transition, Vol. 48, No. 7, pp. 67

- 81.

. Economic Competitiveness Rating - Russia Compared to

Continent - http://www.globalpropertyguide.com/Europe/Russia/competitiveness